The process of building materials’ distribution is complicated and requires consideration of many aspects. It is like putting together a puzzle, so that the entire sales network works together and generates maximum profits. Manufacturers of building materials have many distribution channels to choose from for their products. Some allow them to reach a wider audience, others enable reaching certain niches. Choosing the right ones, therefore, should be well thought out and tailored to the manufacturer’s specifics, as well as adapted to current market trends. It is not always the DIY market that guarantees the highest sales, focusing on specialist shops may in turn prove ineffective in other cases. So, how do you choose the right sales channels for building materials?

Diversity of entities in distribution

The distribution of building materials is usually a complex network. This is due to the variety of formats in which construction and finishing materials can be sold. Investors and contractors have various options when it comes to outlets with construction assortment. Their choices, in turn, determine the appearance of the distribution network of individual manufacturers. In addition to DIY stores, most often chosen by individual investors, and construction warehouses/wholesalers, which in turn are most often stocked by professionals, building materials can also be purchased directly from the manufacturer or in authorized stores offering products from one or several manufacturers.

Choice of purchase location

Different distribution channels differ in their offerings, pricing policies, and market penetration. Markets and construction warehouses and wholesalers offering a wide range of products and allowing comparison of offerings of many manufacturers in one place remain crucial for the distribution market of building materials. However, consumers also willingly choose specialised stores distributing products of one or only a few manufacturers, which provide a greater sense of security, especially for more expensive and technically demanding products.

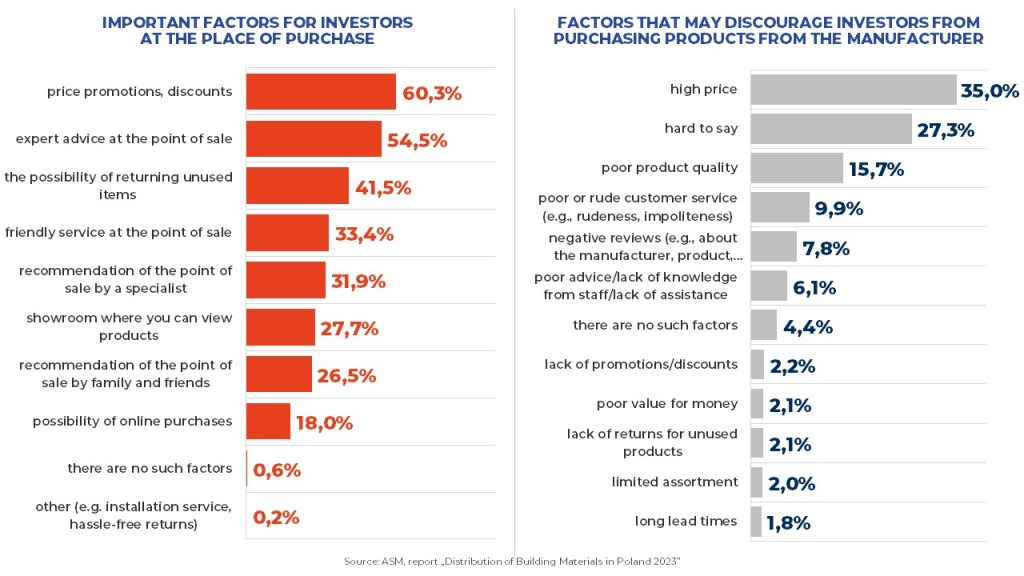

Hence the question arises: which sales channel should be chosen for my product? The analysis of the effectiveness of the sales channel should begin with profiling your own customers, i.e., who they are and how they make purchases. Of course, there are also general trends for the construction market that should be taken into account. According to our research, currently, the most significant factor for investors are financial issues. For 60% of investors, the key factor determining the choice of purchase location is the offered sales and discounts. At the same time, it is the high price that discourages more than a third of consumers from purchasing building materials from a specific manufacturer. For over half of the respondents, professional advice at the point of sale is also important, and 41.5% of Poles will choose a building store where they will have the opportunity to return unused items.

Building materials sales and price

The market for the distribution of building materials is currently in the initial phase of revival, characterized by a slow return to renovation and construction investments that were suspended in recent months. Consequently, there is an increasing demand for building and finishing materials. Already in September, another positive signal emerged from the building materials market, indicating a revival of the sector, as there an increase in the sale of building materials was observed: by 17% in the category of cement and lime, and by 12% in the category of walls and chimneys.

Another positive factor contributing to the increase in demand for building materials is undoubtedly the trend related to their prices. In September of this year, there was a decrease of 0.6% year-on-year, marking the first decline in prices of building and finishing materials in several years! Decreases are being observed in most product categories; however, prices continue to rise, albeit at a much slower pace. Comparing data for the first 9 months of the current year to the previous year, the increase in prices amounted to 6%. However, after a period of stagnation, interest in construction and renovations is slowly reviving, leading to an increase in demand for building materials.

As every year, we have conducted a comprehensive analysis of the entire building materials distribution market. The sector is experiencing growth paralleling the expansion of the construction industry. This growth is primarily driven by the development of existing infrastructure, the increasing number of residential and commercial construction projects, leading to a heightened demand for construction and finishing materials.

- What was the value of the building materials distribution market in 2022?

- What are the forecasts for the size of the building materials distribution market for 2023-2024?

- What share of the market structure is accounted for by DIY markets, what share by construction warehouses/wholesalers, and what share by other players?

- How many building material stores are there in Poland and in individual voivodeships? And what is the situation among construction warehouses/wholesalers?

- Which building material stores and networks are the most recognized by Poles?

- What factors do Poles consider when choosing? And what might discourage them from purchasing building materials?

- What determines the building materials market?

Answers to these and many more questions regarding the market can be found in one of our bestselling publications – “Distribution of Building Materials in Poland”.

For more information, please contact Alina Wozniak, a.wozniak@asmresearch.pl